Welcome to our comprehensive guide on how to increase EPS in BSG. In this article, we’ll delve into the world of earnings per share (EPS) and provide you with actionable strategies to boost your company’s financial performance.

EPS is a crucial metric that measures a company’s profitability and is widely used by investors to assess its value. By understanding the factors that influence EPS and implementing effective strategies, you can unlock the potential for significant financial growth.

Revenue Optimization

Revenue optimization is a crucial strategy for businesses to increase their earnings and profitability. It involves implementing various techniques to maximize revenue from existing customers and markets.

Effective revenue optimization requires a comprehensive approach that includes pricing strategies, upselling, cross-selling, and customer loyalty programs. Understanding customer behavior and preferences is also essential for identifying opportunities for revenue growth.

Pricing Strategies

Pricing strategies play a significant role in revenue optimization. Businesses can consider the following approaches to optimize pricing:

- Value-based pricing:Setting prices based on the perceived value of the product or service to the customer.

- Competitive pricing:Matching or adjusting prices based on competitors’ offerings.

- Dynamic pricing:Adjusting prices based on factors such as demand, time, and customer behavior.

Cost Reduction

To increase EPS in BSG, cost reduction is essential. By identifying key areas for cost reduction, companies can improve their financial performance and profitability.

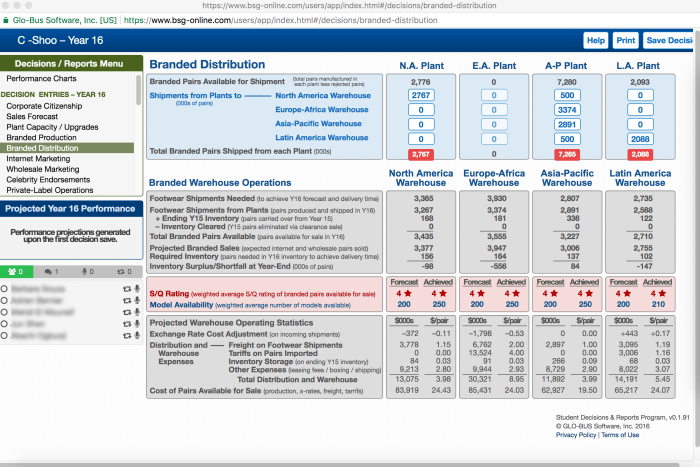

Key areas for cost reduction include procurement, operations, and overhead expenses. By optimizing inventory management, reducing waste, and negotiating better supplier contracts, companies can significantly lower their procurement costs.

Procurement

- Implement vendor management programs to evaluate and negotiate with suppliers.

- Centralize procurement to streamline processes and reduce costs.

- Use technology to automate procurement tasks and improve efficiency.

Operations

- Analyze production processes to identify areas for improvement.

- Implement lean manufacturing principles to reduce waste and increase efficiency.

- Use technology to automate tasks and improve productivity.

Overhead Expenses

- Review administrative and general expenses to identify areas for cost reduction.

- Negotiate better terms with vendors for services such as insurance and utilities.

- Explore outsourcing options for non-core functions.

Margin Improvement

Margin improvement is crucial for increasing EPS, as it directly impacts the company’s profitability. Gross margin and operating margin are two key metrics used to assess profitability, and they provide insights into the company’s pricing power, cost structure, and operational efficiency.

Gross margin measures the profit earned per unit of sales, while operating margin measures the profit earned from core business operations. By improving margins, companies can increase their EPS and enhance their overall financial performance.

Product Mix Optimization

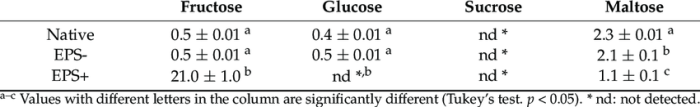

- Focus on selling high-margin products or services to increase gross margin.

- Analyze customer preferences and demand to adjust product offerings accordingly.

- Offer incentives or discounts on low-margin products to clear inventory and make way for higher-margin items.

Cost Reduction

- Negotiate better terms with suppliers to reduce raw material costs.

- Implement lean manufacturing principles to minimize waste and improve efficiency.

- Automate processes to reduce labor costs.

Operational Efficiency, How to increase eps in bsg

- Improve inventory management to reduce holding costs and optimize stock levels.

- Optimize supply chain operations to minimize transportation and logistics expenses.

- Implement technology to enhance productivity and reduce operating expenses.

Share Buybacks and Dividends

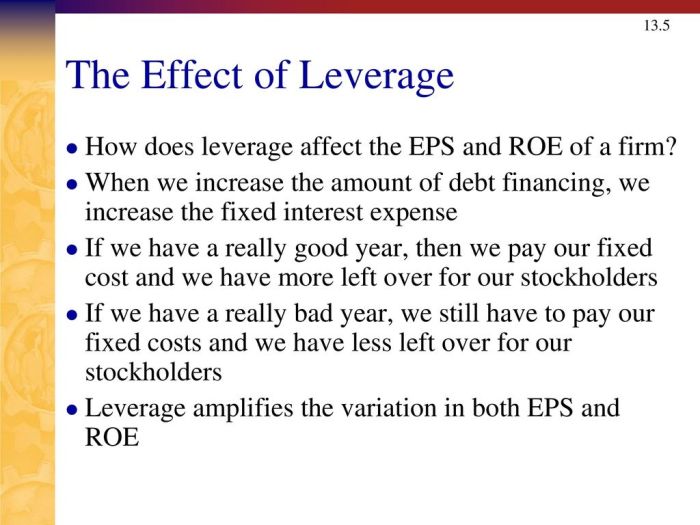

Share buybacks and dividends are two strategies that companies use to distribute earnings to shareholders. Both can impact earnings per share (EPS), but in different ways.

Share Buybacks

A share buyback is when a company repurchases its own shares from the market. This reduces the number of shares outstanding, which can increase EPS because the same amount of earnings is now spread over a smaller number of shares.

Enhancing your understanding of mathematical concepts is crucial for boosting EPS in BSG. Consider exploring Envision Math 2.0 Volume 1 , a comprehensive resource that offers clear explanations and engaging activities. By mastering these concepts, you’ll be well-equipped to optimize EPS and achieve greater success in BSG.

Share buybacks can be a good way to increase EPS in the short term. However, they can also be expensive and can reduce the company’s financial flexibility.

Dividends

A dividend is a distribution of earnings to shareholders. Dividends are typically paid quarterly or annually. Dividends can reduce EPS because they reduce the amount of earnings that are available to be reinvested in the company.

Dividends can be a good way to provide shareholders with a regular stream of income. However, they can also reduce the company’s financial flexibility and can limit its ability to invest in growth.

Choosing Between Share Buybacks and Dividends

The decision of whether to use share buybacks or dividends depends on a number of factors, including the company’s financial situation, its growth prospects, and the preferences of its shareholders.

In general, share buybacks are more appropriate for companies that are mature and have limited growth prospects. Dividends are more appropriate for companies that are growing and need to retain their earnings to fund their growth.

Impact on Stock Price and Shareholder Value

Both share buybacks and dividends can have a positive impact on stock price and shareholder value. Share buybacks can increase EPS, which can lead to a higher stock price. Dividends can provide shareholders with a regular stream of income, which can also lead to a higher stock price.

However, it is important to note that share buybacks and dividends are not always the best way to increase shareholder value. In some cases, it may be better to use the company’s earnings to invest in growth initiatives or to reduce debt.

EPS Forecasting and Sensitivity Analysis: How To Increase Eps In Bsg

EPS forecasting is crucial for understanding a company’s future profitability and making informed investment decisions. By leveraging historical data, industry trends, and economic indicators, investors can develop accurate EPS forecasts. Sensitivity analysis helps assess the impact of changes in key variables, such as revenue, costs, and tax rates, on EPS.

These forecasts provide valuable insights into a company’s financial health and growth potential.

Historical Data Analysis

Historical EPS data provides a solid foundation for forecasting. By analyzing trends, seasonality, and the impact of past events, investors can identify patterns and make informed projections. Statistical techniques, such as regression analysis, can be used to quantify these relationships.

Industry Trends and Economic Indicators

Industry trends and economic indicators influence a company’s EPS. Monitoring industry growth rates, competitive dynamics, and regulatory changes can provide valuable insights into future EPS performance. Economic indicators, such as GDP growth, interest rates, and inflation, can also impact EPS.

Sensitivity Analysis

Sensitivity analysis assesses the impact of changes in key variables on EPS. By varying these variables within reasonable ranges, investors can gauge the potential impact on EPS. This analysis helps identify the most sensitive variables and their impact on the company’s financial performance.

EPS Forecasts in Investment Decisions

EPS forecasts are essential for making informed investment decisions. By comparing forecasted EPS with current and past EPS, investors can assess a company’s growth potential and valuation. EPS forecasts also help identify companies that are undervalued or overvalued relative to their peers.

General Inquiries

What is the significance of EPS?

EPS is a key indicator of a company’s profitability and is used by investors to evaluate its financial health and potential for growth.

How can I optimize revenue to increase EPS?

Revenue optimization involves implementing strategies such as pricing adjustments, upselling, cross-selling, and customer loyalty programs to maximize revenue generation.

What are the key areas for cost reduction?

Cost reduction can be achieved by optimizing procurement processes, reducing waste, and negotiating favorable supplier contracts.

How do share buybacks and dividends impact EPS?

Share buybacks reduce the number of shares outstanding, which can increase EPS. Dividends, on the other hand, represent a distribution of profits to shareholders and can reduce EPS.